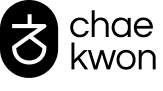

Summary

Role: Product Designer

Duration: Oct - Nov 22 (1 mo)

Feature Shipped: Feb 2023

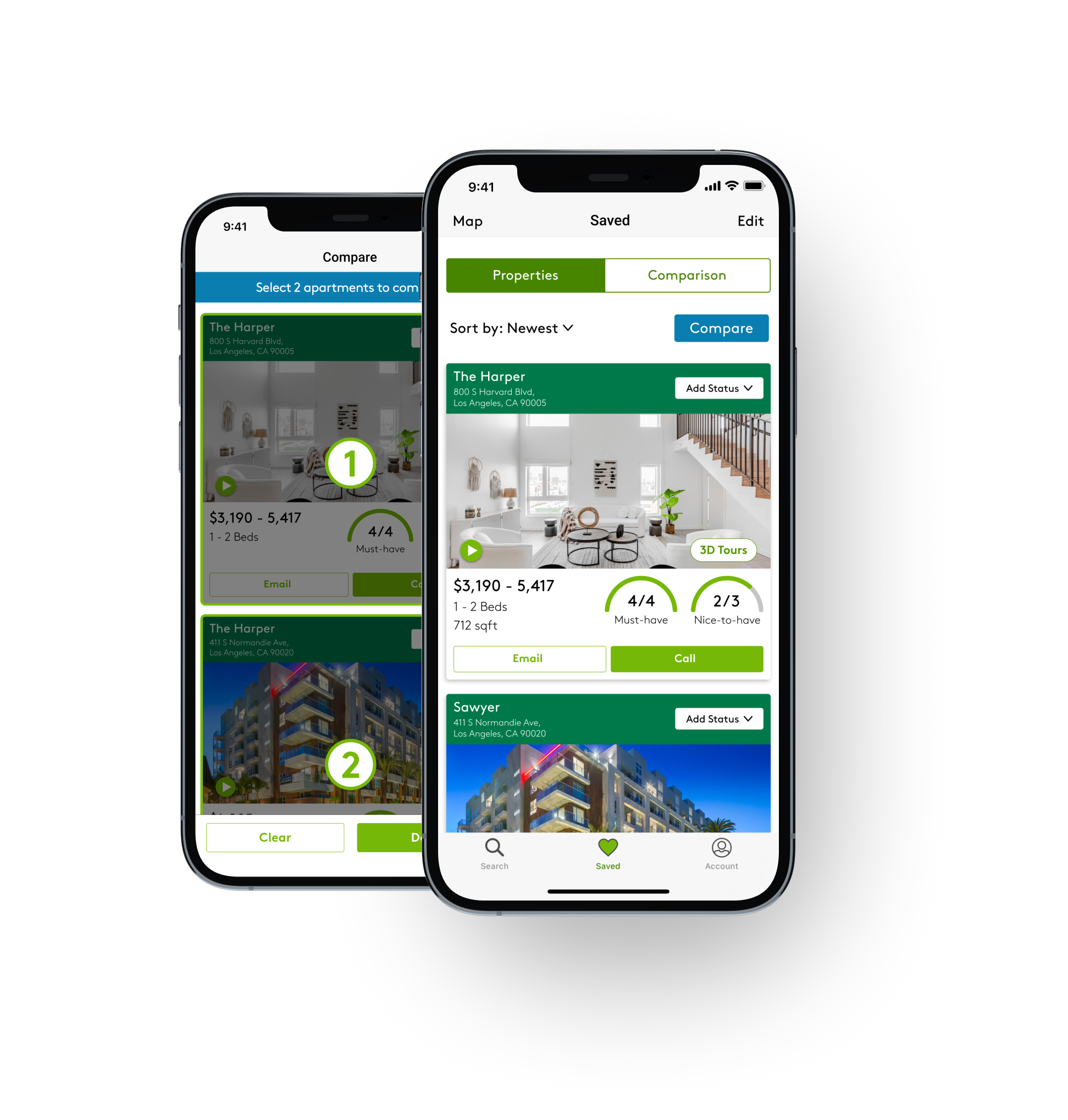

About: Extra is a debit card that helps build credit. When users make a transaction with their Extra debit card, we cover their purchase like a credit card and pay ourselves back the next day by withdrawing from the user's bank account. We automatically attempt to pull money out of their bank account but sometimes for whatever reason, we're unable to pull money out of user's bank accounts. We refer to this as "failed ACH" or "failed invoices," and the increasing trend of such occurrences has resulted in financial losses for the company. We developed a payment portal feature that would mitigate this loss.

New Feature

The payment portal allows users to make manual payments within the app regarding their failed invoices.

This gives more transparency and autonomy for users to resolve the problem within the app on their own instead of waiting for retries or having to contact customer service.

KPIs

Feature success: significant reduction in failed transactions and customer service tickets unlocked financial stability and enhanced customer support.

57% ↓

Failed ACH

Overall decreased failed transactions by 57%, indicating that the company effectively mitigated financial losses caused by unpaid invoices.

24% ↓

Customer Service Tickets

Decreased customer service tickets regarding locked cards & failed transactions by 24%, effectively freeing up additional bandwidth for customer service agents to handle other pressing issues and provide enhanced support.

Process

Discovering the Problems

Users are unable to resolve failed invoices on their own, resulting in an increased manual workload for the team.

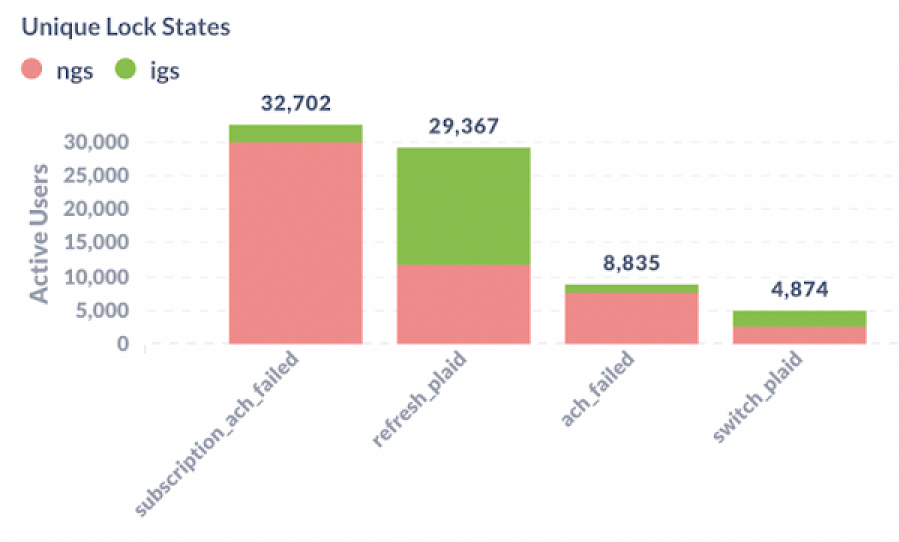

- Users with failed invoices get their debit cards locked, resulting in substantial revenue loss for the company. Over 30,000 users are in this state.

- Users lack visibility into the problem's cause and there isn't a pathway to recover from errors.

- Lots of manual work is required from the Customer Service Team, leaving a lot of data uncaptured.

Product Requirement

Optimizing UX for manual payment requires seamless integration, transaction transparency, and churn prevention.

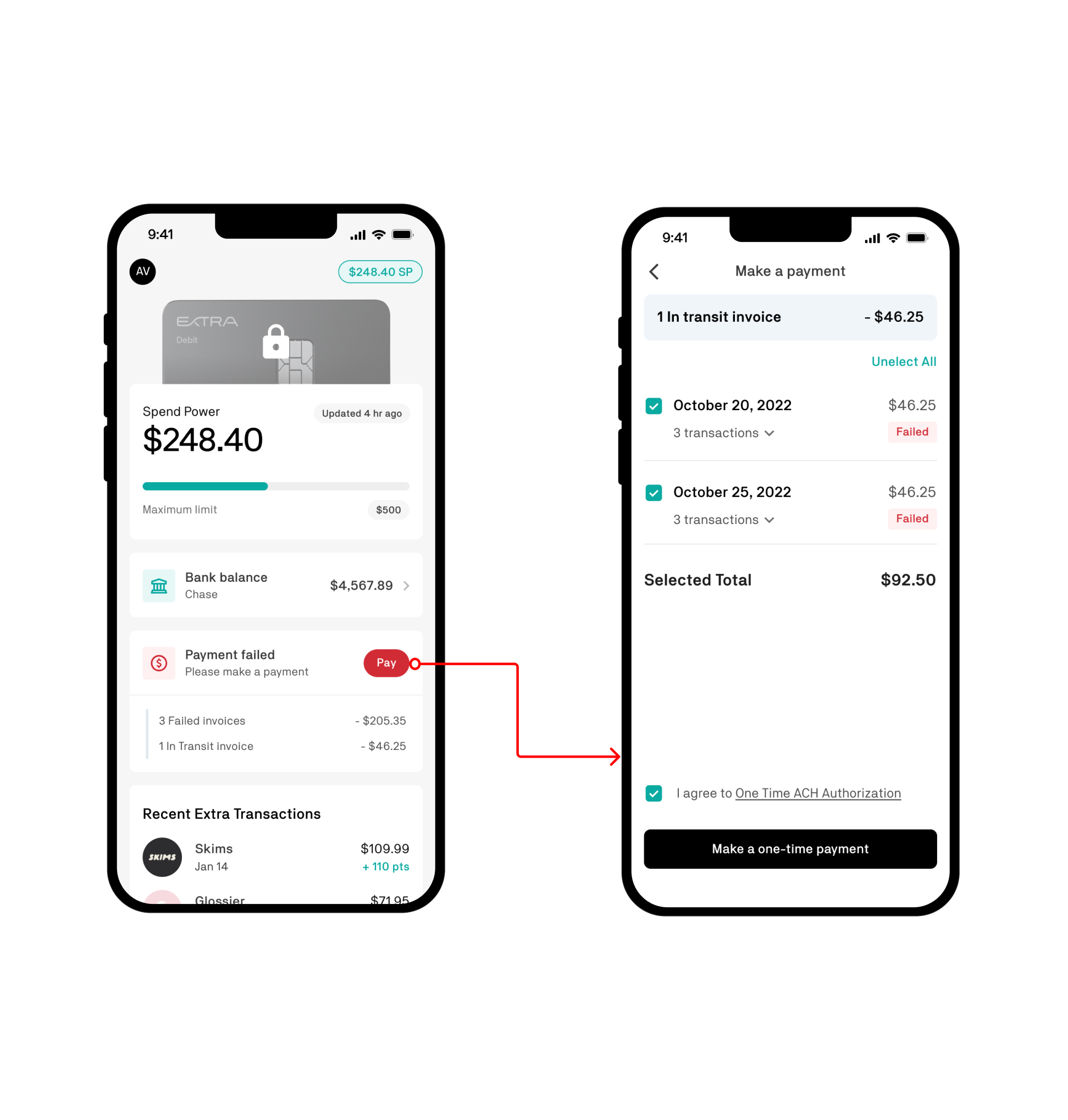

- The user flow for manual payment should be both easily discoverable and seamlessly integrated to minimize disruption.

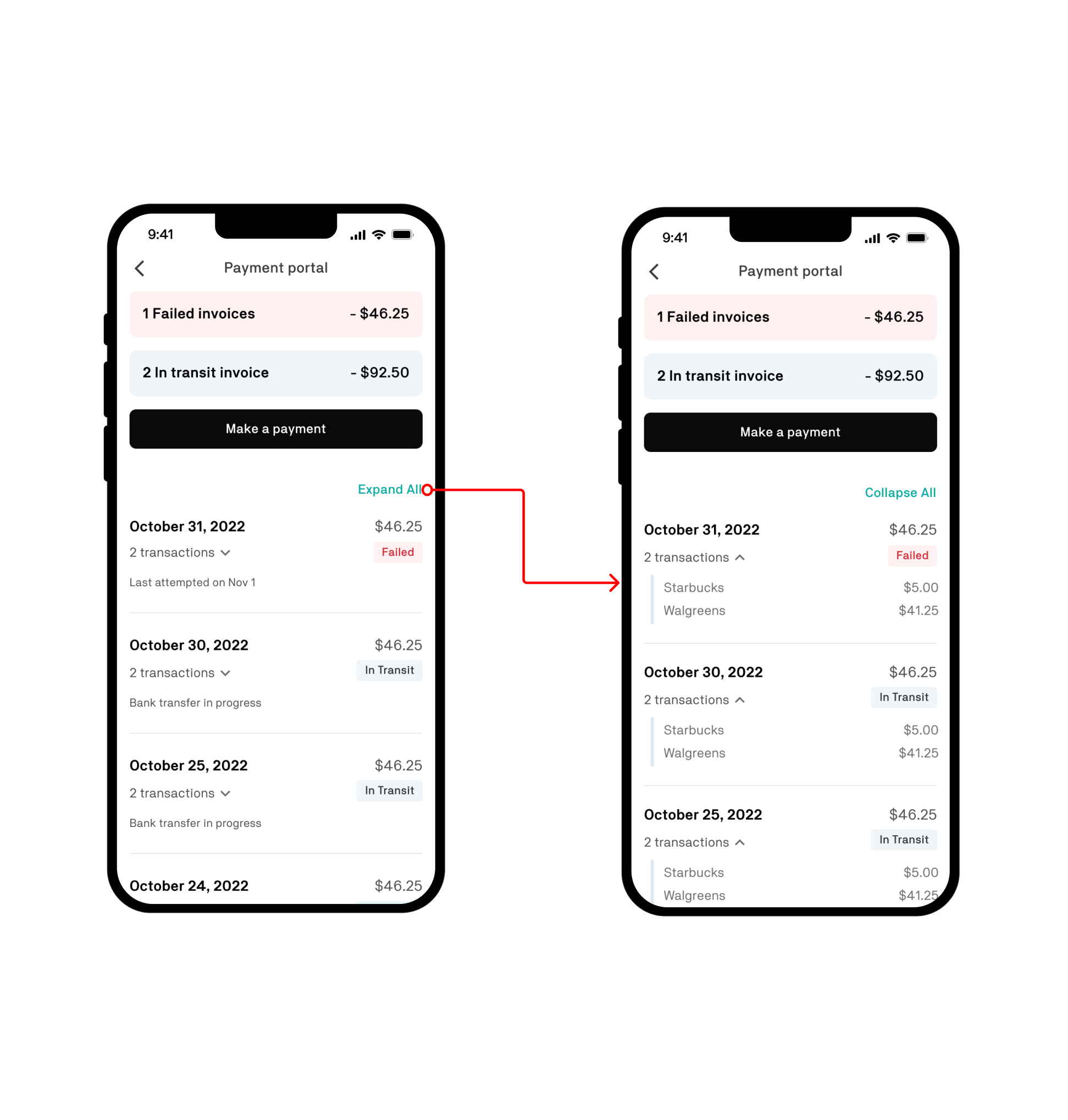

- Users should have a clear understanding of the different transaction statuses for improved transparency and comprehension.

- The user experience should incorporate proactive measures to prevent default churn caused by unpaid invoices.

Business goal

Mitigate the revenue loss caused by outstanding invoices and decrease the workload of customer service agents.

Feature Breakdown

How Extra Debit Card Works: When users make a transaction with their Extra debit card, we cover their purchase like a credit card and pay ourselves back the next day by withdrawing from the user's bank account. We automatically attempt to pull money out of their bank account but sometimes for whatever reason (i.e. insufficient bank balance), we're unable to pull money out of user's bank accounts. We call this "failed ACH" or "failed invoices",

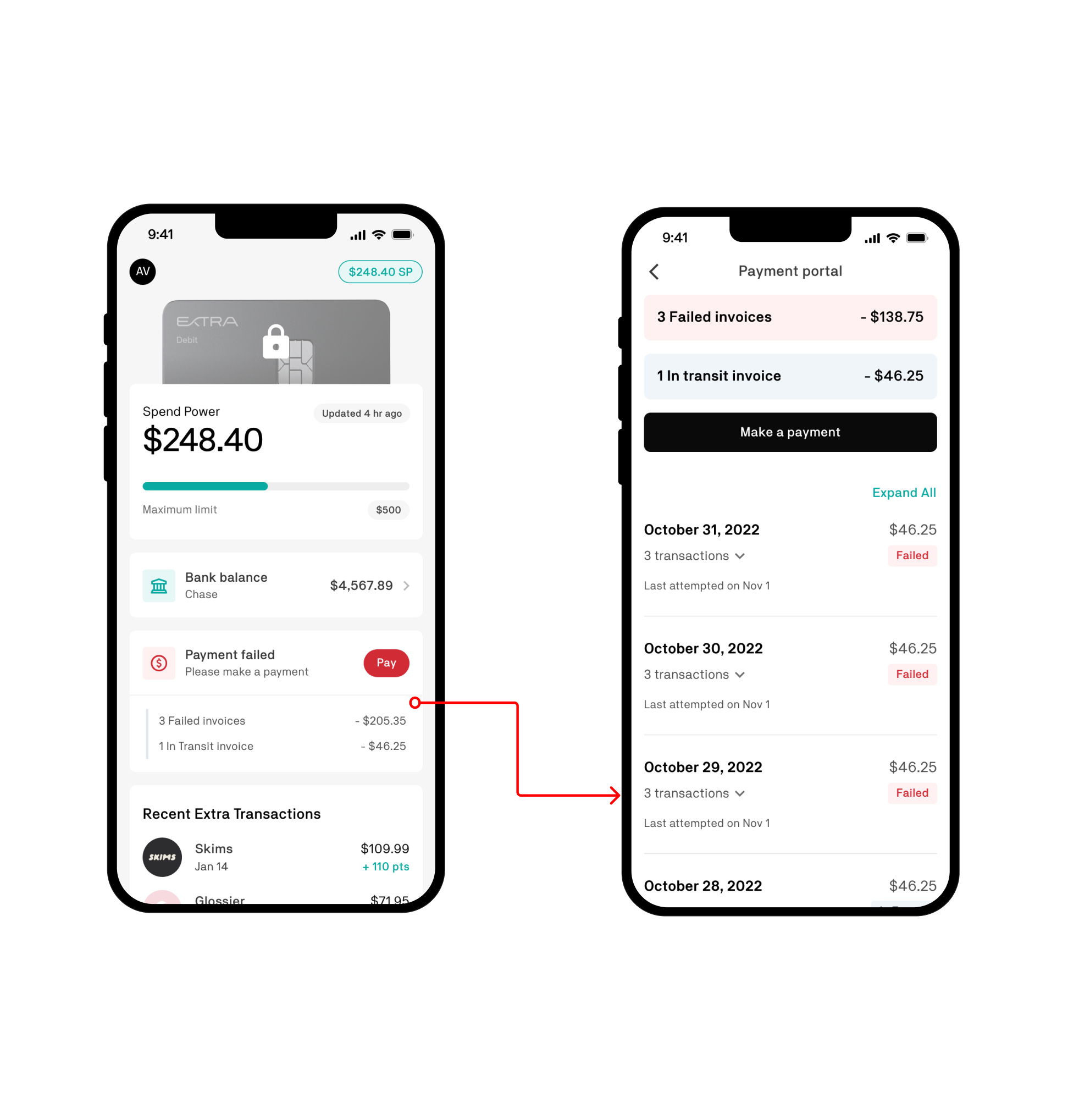

Manual payment

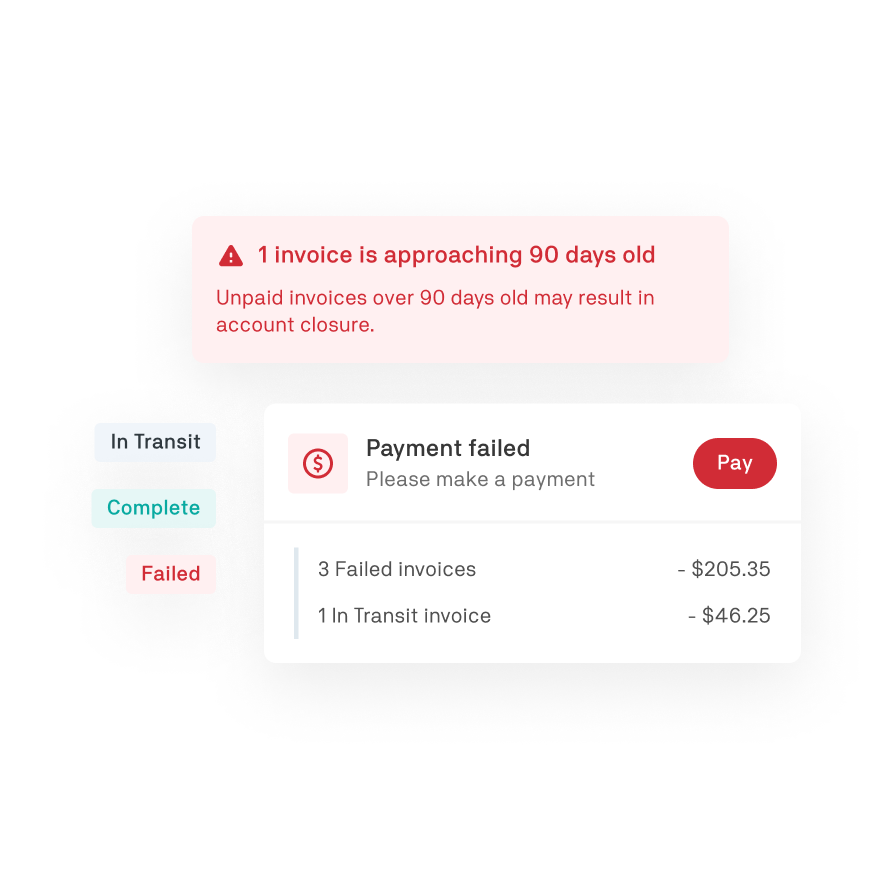

Failed invoices are prominently displayed above the fold on the home tab, allowing users to easily identify them, view their status, and take initiative to make payments at their convenience, fostering transparency and empowering user autonomy.

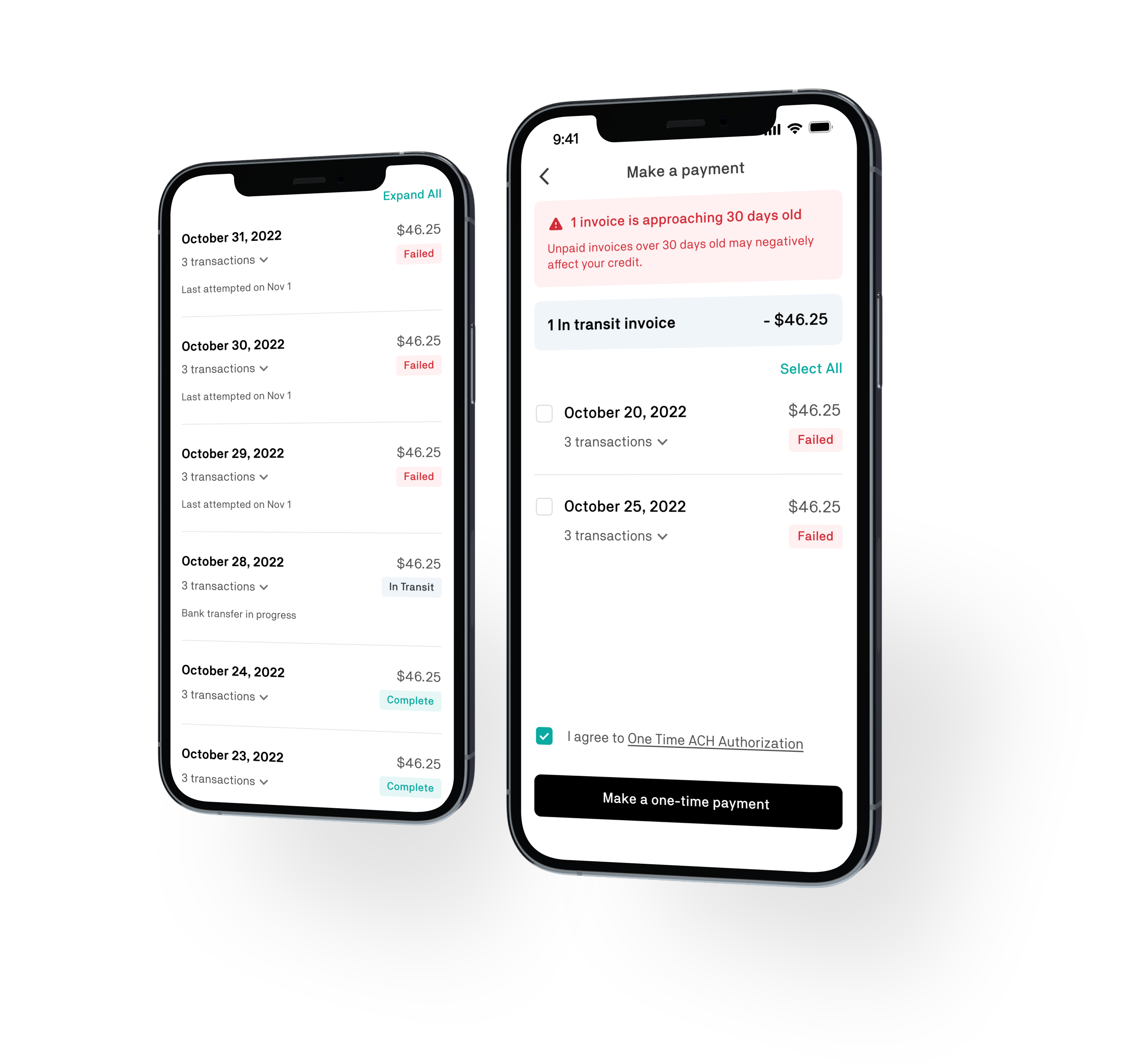

Account closure risk

Unpaid invoices that remain outstanding for more than 90 days can lead to account closure, which in turn may have a detrimental effect on the user's credit score; to avoid such consequences, we proactively notify users when invoices are approaching the 30-day and 90-day thresholds.

View daily spend invoices

When users make one or more transactions using the Extra Debit Card, we aggregate the total amount and automatically initiate a withdrawal from their bank account the following day, referred to as "Daily Spend Invoices". Payment portal feature provides users with a clear view of invoice statuses for better comprehension of their debit card activity.

Final Thoughts

Lessons

Facilitating understanding through incremental repetition: The Extra Debit Card serves as an innovative credit-building solution for users who are unable to open credit cards, but comprehending its functionality may require some time. With the introduction of the payment portal, it becomes even more vital for users to grasp the process. We discovered that overwhelming users with detailed explanations all at once is counterproductive, thus the most effective approach involves reiterating key points in various contexts, delivering information in manageable increments.

Selected Works